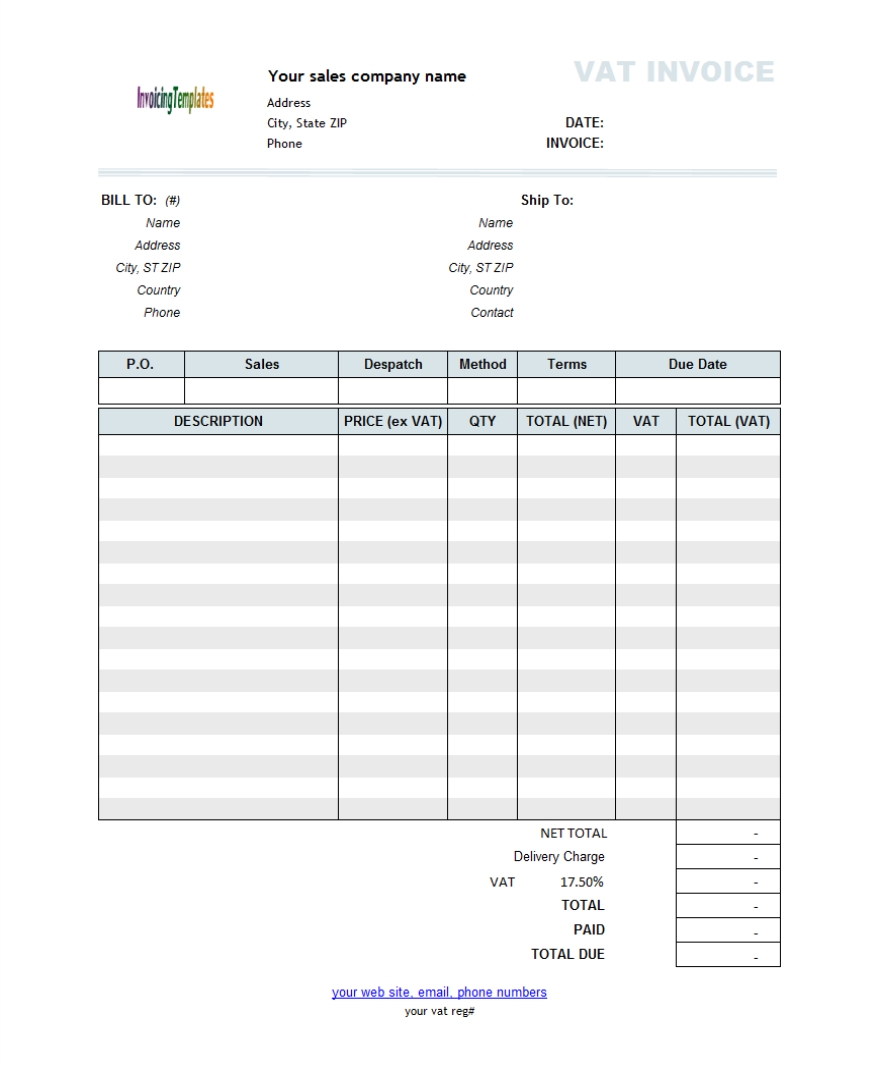

The customer is required to pay the seller before the shipment of goods.Ĭash on Delivery (or Collection on Delivery) The customer must include payment when submitting an order. Payment in Advance on a contractor’s construction project is a stage payment that may require a 10% to 50% upfront deposit. The customer must pay the seller before delivery of goods or work starting on a project. Seller requires upfront payment by the customer before order shipment. Common Payment Terms for Payment Due Dates Payment Term Abbreviation Some due dates are paired with early payment discounts offered, like 2/10 net 30, which offers the customer a 2% discount on invoices paid within 10 days of the invoice date.Īlthough Net 30 and Net 60 are the most common payment due date terms with no discount, the seller may specify a different due date like Net 10, Net 15, Net 45, or Net 90 instead.Īs part of the payment process, invoices with a payment date that’s due after the delivery date are included in the customer’s accounts payable journal before they are paid. Payment Timing, Due Dates, and Discounts Offered The delivery company transmits payments to the seller (via direct deposit) within about two days. A COD customer pays through the final-mile delivery company, like UPS, when their purchased items are delivered. Some payment terms are transaction or customer-specific.Ĭustomers with financial problems may be assigned CIA (cash in advance), PIA (payment in advance), or COD terms by the seller’s credit department to avoid non-payment. Common Examples of Payment TermsĬompanies often use standard payment terms for routine transactions for credit-worthy customers. Consignment is the riskiest because the seller doesn’t get paid until the item is sold by the buyer to a future customer. Payment methods for global trade, according to the U.S.-based International Trade Association, include:Ĭash-in-advance (CIA) is the least risky method. This list isn’t complete (see Common Examples of Payment Terms below). Payment terms can include cash in advance (CIA), cash with order (CWO), cash before shipment (CBS), cash on delivery (COD), cash next delivery (CND), barter terms, or specified payment terms for purchases on account that are payable after receiving the goods or services.īusinesses can exercise creativity in setting payment terms. Where to pay (online website URL, mailing address, or physical location).Additional terms or payment methods for international shipments.Days due/early payment discount percentage terms ( net 30, 2/10 net 30, COD, etc.).Which types of items on an invoice are payment terms? Contributing to company results earns recognition, increases competence, differentiates you from your peers, and may justify a pay raise or promotion. You’ll help optimize your company’s cash flow and ability to receive shipments from vendors when needed. Apply productive payment term strategies and tactics. Have you thought about this true statement? Technically ANY purchase has payment terms.ĭevote a little time to understanding payment terms.

You can figure out the why if your business wants to avoid empty inventory shelves or the ramifications of unpaid invoices. If you’re thinking of the Five Ws that journalists use to write a story, there’s an extra H for how instead of a W for why.

INVOICE PAYMENT MEANING HOW TO

Payment terms include who, when, where, what, and how to pay. The list of specific information commonly included in invoice payment terms is even more comprehensive. Payment terms include the amount, invoice date, how to pay, payment methods, early payment discount percentage, penalties, and due dates. Although payment terms may be negotiated, often the seller sets payment terms for routine sales transactions. Payment terms from a contract or purchase order are included on an invoice to the customer. Payment terms are specifications of amounts owed, how, when, and where payments are due on sales transactions between sellers and buyers.

0 kommentar(er)

0 kommentar(er)